Navigating the world of health insurance can feel overwhelming—especially if you're new to it. With a maze of plans, confusing jargon, and endless options, it's no wonder many people feel lost when choosing the right coverage. But understanding health insurance doesn’t have to be complicated. Whether you're selecting a plan for the first time, switching jobs, or helping a loved one make informed decisions, this beginner’s guide will break down everything you need to know in a simple, human way.

From the different types of health insurance to what’s typically covered and the key terms you’ll encounter, we’ve got you covered. Let’s take a deep breath and dive in.

Why Health Insurance Matters

Imagine this: You suddenly develop severe abdominal pain and end up in the emergency room. The diagnosis? Appendicitis. Surgery is needed immediately. Without health insurance, that single hospital visit could cost tens of thousands of dollars. But with insurance, you might only pay a fraction of that cost—your deductible, co-pay, or coinsurance—while the insurance company covers the rest.

Health insurance is essentially a safety net. It protects you from the financial shock of unexpected medical expenses. It also encourages preventive care—like annual checkups, vaccinations, and screenings—so you can catch health issues early, when they’re easier and less expensive to treat.

In short, health insurance isn’t just about covering emergencies. It’s about peace of mind, financial security, and taking control of your health.

The Basics: How Health Insurance Works

At its core, health insurance is a contract between you and an insurance company. You pay a monthly fee—called a premium—and in return, the insurer agrees to pay part (or sometimes all) of your medical expenses when you need care.

Here’s how it typically works:

- You pay a premium every month to keep your coverage active.

- When you visit a doctor or hospital, the provider sends a bill to the insurance company.

- The insurer pays a portion of the bill based on your plan’s rules.

- You pay your share—this could be a co-payment, coinsurance, or deductible.

The amount you pay depends on your specific plan and the type of service you receive.

Types of Health Insurance Plans

Not all health insurance is the same. There are several types of plans, each with its own rules, benefits, and limitations. Understanding the differences is key to choosing the right one for you.

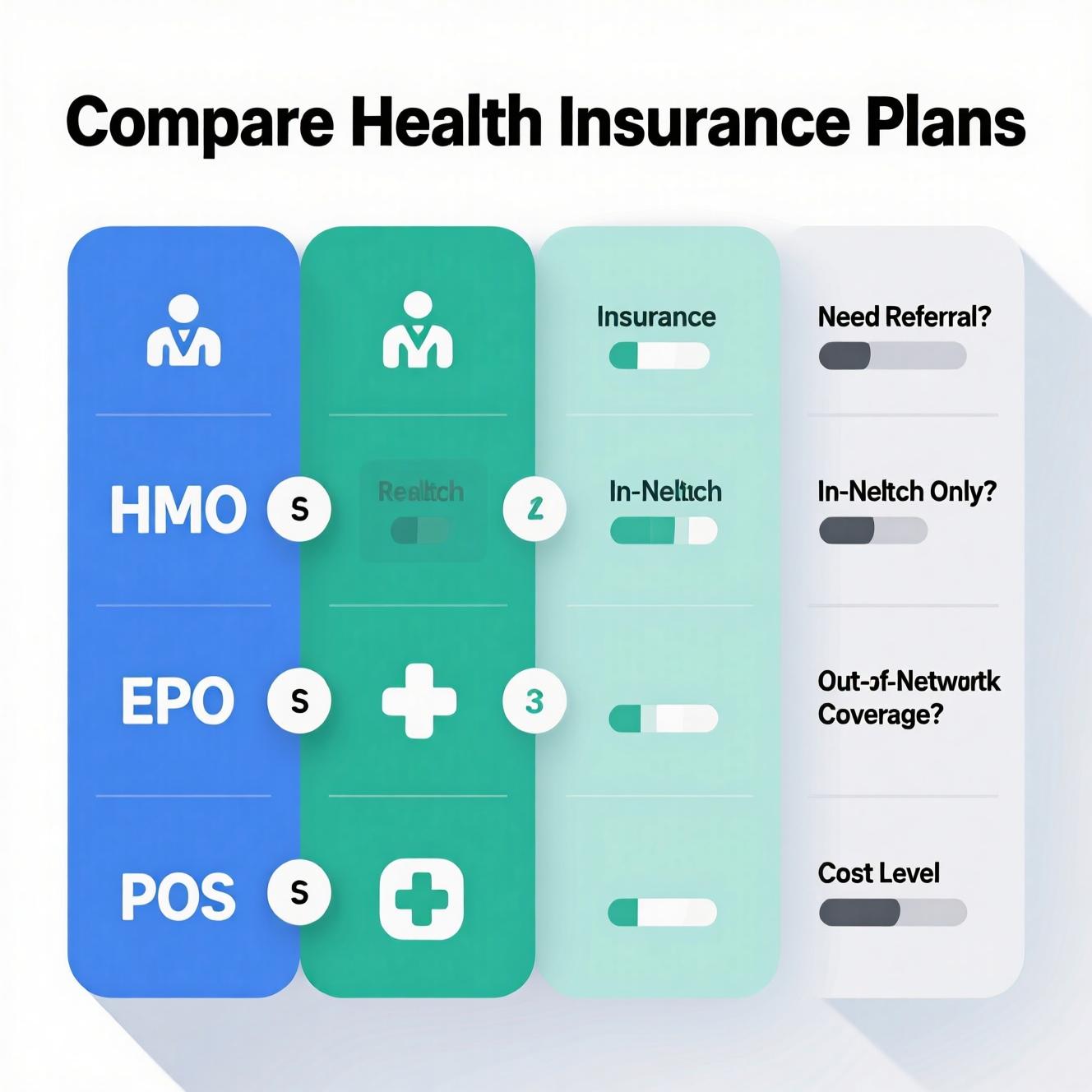

1. Health Maintenance Organization (HMO)

An HMO plan is one of the most common and affordable options. It usually requires you to choose a Primary Care Physician (PCP)—a doctor who coordinates your care. If you need to see a specialist (like a cardiologist or dermatologist), you’ll typically need a referral from your PCP.

Pros:

- Lower premiums and out-of-pocket costs.

- Emphasis on preventive care.

- Predictable costs.

Cons:

- You must stay within the network of approved doctors and hospitals (except in emergencies).

- Referrals are required for specialists.

- Less flexibility if you want to see providers outside the network.

Best for: People who want lower costs and don’t mind having a primary doctor manage their care.

2. Preferred Provider Organization (PPO)

A PPO offers more flexibility than an HMO. You don’t need a referral to see a specialist, and you can visit doctors both inside and outside the network. However, going out-of-network usually costs more.

Pros:

- No need for referrals to see specialists.

- Greater choice of doctors and hospitals.

- Coverage for out-of-network care (though at a higher cost).

Cons:

- Higher monthly premiums.

- More complex billing and paperwork.

- Higher out-of-pocket costs if you go out of network.

Best for: People who value flexibility and may want to see specialists or providers outside their local area.

3. Exclusive Provider Organization (EPO)

An EPO is a hybrid between an HMO and a PPO. Like an HMO, you must use in-network providers (except in emergencies), but like a PPO, you don’t need a referral to see a specialist.

Pros:

- Lower premiums than PPOs.

- No referrals needed for specialists.

- Good balance of cost and flexibility.

Cons:

- No coverage for out-of-network care (except emergencies).

- Limited provider network.

Best for: Those who want more freedom than an HMO but are willing to stay in-network to save money.

4. Point of Service (POS)

A POS plan combines features of HMOs and PPOs. You choose a PCP who refers you to specialists, but you can also go out of network—though it will cost more.

Pros:

- Lower costs for in-network care.

- Option to go out of network (with higher costs).

- Preventive care is emphasized.

Cons:

- Requires referrals for specialists.

- More complex cost structure.

- Higher out-of-pocket costs if you go out of network.

Best for: People who want a primary care coordinator but also want the option to see out-of-network providers when necessary.

5. High-Deductible Health Plan (HDHP) with Health Savings Account (HSA)

An HDHP has lower monthly premiums but a higher deductible—the amount you must pay out of pocket before insurance starts covering costs. These plans are often paired with a Health Savings Account (HSA), which lets you save money tax-free for medical expenses.

Pros:

- Lower monthly premiums.

- Tax advantages with HSA.

- Encourages cost-conscious healthcare decisions.

Cons:

- High out-of-pocket costs before insurance kicks in.

- Not ideal for people with frequent medical needs.

- Can be risky if you face a major illness early in the year.

Best for: Healthy individuals or families who don’t expect many medical expenses and want to save on premiums and taxes.

What Does Health Insurance Cover?

Most health insurance plans cover a range of essential health benefits, especially those sold through the Health Insurance Marketplace (under the Affordable Care Act). These include:

- Doctor visits (primary care and specialists)

- Hospitalization (inpatient and outpatient care)

- Emergency services

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative and habilitative services (like physical therapy)

- Laboratory tests

- Preventive services and screenings (e.g., mammograms, colonoscopies, vaccines)

- Pediatric services, including dental and vision care for children

However, coverage can vary significantly between plans. For example, one plan might cover acupuncture or chiropractic care, while another doesn’t. Always read the Summary of Benefits and Coverage (SBC)—a document that clearly outlines what’s covered and what you’ll pay.

Key Health Insurance Terms You Need to Know

Understanding the language of health insurance is half the battle. Here are the most important terms you’ll encounter:

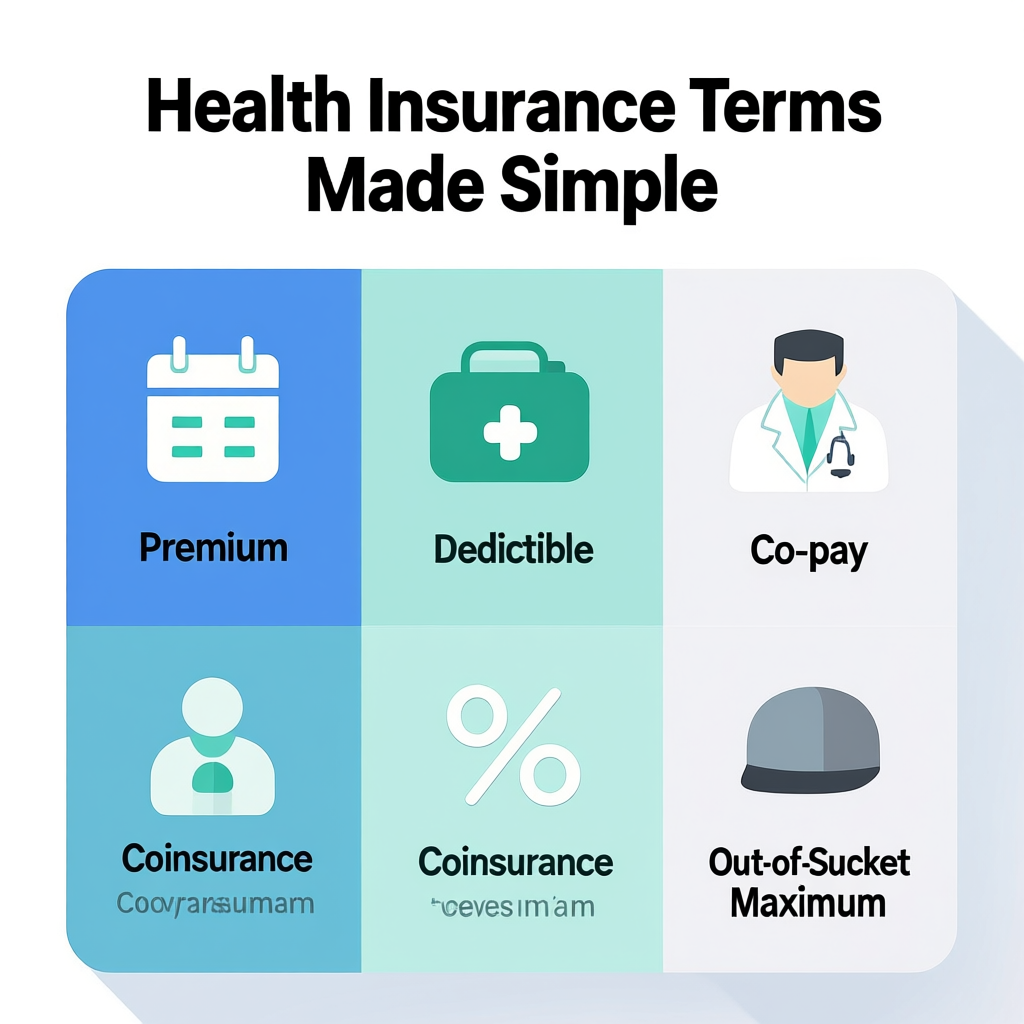

1. Premium

The amount you pay each month to maintain your health insurance, regardless of whether you use medical services. Think of it like a subscription fee.

2. Deductible

The amount you must pay out of pocket for covered services before your insurance starts to pay. For example, if your deductible is $1,500, you’ll pay 100% of eligible medical costs until you’ve spent $1,500.

3. Co-payment (Co-pay)

A fixed amount you pay for a specific service. For example, you might pay a $25 co-pay to see your primary doctor or a $50 co-pay for a specialist visit.

4. Coinsurance

The percentage of costs you pay after meeting your deductible. If your plan has 20% coinsurance, you pay 20% of the bill, and the insurer pays 80%.

5. Out-of-Pocket Maximum

The most you’ll have to pay in a year for covered services. Once you hit this limit, your insurance covers 100% of eligible costs for the rest of the year. This includes deductibles, co-pays, and coinsurance—but not premiums.

6. Network

A group of doctors, hospitals, and other providers who have contracts with your insurance company. Using in-network providers usually costs less.

7. Prior Authorization

A requirement that your doctor get approval from the insurance company before certain treatments or medications are covered.

8. Explanation of Benefits (EOB)

A statement from your insurer that explains what services were billed, how much the insurance paid, and what you owe.

9. Formulary

A list of prescription drugs covered by your plan, often divided into tiers with different cost levels.

10. Pre-Existing Condition

A health problem you had before your insurance started. Under the Affordable Care Act, insurers cannot deny coverage or charge more because of pre-existing conditions.

How to Choose the Right Health Insurance Plan

Choosing a plan isn’t just about finding the cheapest option. It’s about finding the best value for your needs. Here’s how to decide:

1. Assess Your Health Needs

Are you generally healthy? Do you have a chronic condition like diabetes or asthma? Do you take regular medications? Are you planning surgery or expecting a baby? Your health status will influence which plan makes the most sense.

2. Consider Your Budget

Look beyond the monthly premium. A plan with a low premium might have a high deductible and coinsurance, meaning you could pay more if you get sick. Estimate your total annual costs: premium + expected out-of-pocket expenses.

3. Check the Provider Network

Make sure your current doctors, specialists, and preferred hospitals are in the plan’s network. If not, you could face higher costs or no coverage at all.

4. Review Prescription Drug Coverage

If you take medications regularly, check if they’re on the plan’s formulary and what tier they’re in. A drug in a higher tier could cost significantly more.

5. Look at the Out-of-Pocket Maximum

This is your financial safety net. A lower out-of-pocket maximum can protect you from catastrophic costs if you face a serious illness.

6. Use the Health Insurance Marketplace

If you don’t get insurance through your employer, visit Healthcare.gov (in the U.S.) during open enrollment or a special enrollment period. You can compare plans side by side and may qualify for subsidies based on your income.

Common Myths About Health Insurance

Let’s clear up some misconceptions:

- Myth: “I’m young and healthy, so I don’t need insurance.”

Truth: Accidents and sudden illnesses can happen to anyone. Without insurance, one emergency can lead to financial ruin.

- Myth: “All plans cover the same things.”

Truth: Coverage varies widely. Always read the details.

- Myth: “Going to an out-of-network doctor is always covered.”

Truth: Most plans offer little or no coverage for out-of-network care—except in emergencies.

- Myth: “I can’t get insurance if I have a pre-existing condition.”

Truth: Thanks to the Affordable Care Act, insurers cannot deny coverage or charge more based on health history.

Read also: A Comprehensive Guide to Monthly Budgeting: 7 Simple Steps to Get Started

Final Thoughts: Take Control of Your Health and Finances

Health insurance doesn’t have to be intimidating. By understanding the types of plans, what they cover, and the key terms, you’re already ahead of the game. Remember, the best plan for you depends on your health, budget, and lifestyle.

Take the time to compare options, ask questions, and read the fine print. Your future self—and your wallet—will thank you.

Whether you’re just starting out or reevaluating your current coverage, this health insurance guide is your roadmap to making smarter, more confident decisions. After all, your health is your greatest asset. Protect it wisely.